Reasons to Try Lamb Meat Business

When you want people to buy anything, you can tell them it is going out of stock, or its price is increasing fast, and they may not afford it in the future. Unfortunately, such marketing messages eventually make people insensitive to actual market information about the status of their loved consumable product. People think that they’re going to afford things because of their high availability. Soon enough, they realize the seasoned changed and the foods that were so cheap are suddenly very expensive. One person smiling to the bank in such situations is the producer. Consider yourself as a lamb meat producer. You own a farm, and you are facing a market where buying prices skyrocket. You will make a lot of money selling lamb meat. Also, there are more reasons to try lamb meat business.

Be Greener to the Environment

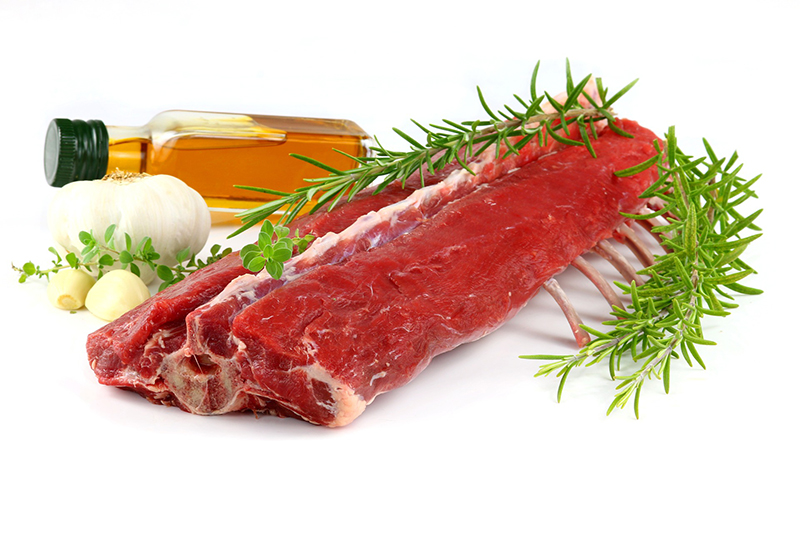

Lamb meat comes from Lamb, which is sheep that is less than a year old. Therefore, it takes a shorter time to farm and gets the meat ready for the market. You can produce more lamb with the same resource that would take to produce less beef. People are in the hunt for ways to reduce their carbon footprint, and they do not want to keep consuming beef for such reasons. Lamb is their go-to alternative since it takes a shorter time to produce, and it does not require as much corn as beef production.

Faster Turnaround Leads to Faster Paychecks

Faster Turnaround Leads to Faster Paychecks

The other good thing with lamb is the ease of turning a profit when you start farming. You can use savings or financing from institutions, and that is going to improve your capability to expand your business. Regular paychecks come because the lamb is ready in one year or less. You can have an annual calendar to allow payment of bills without fail. If you were a producer of other meats that take more than a year, then you would be in a tough position going into debt as you wait for your animals to mature and go to the slaughter.

Contract Farming Options Reduce Business Risk

If selling lamb in an open market is a tricky business for you, then consider going into contract farming with a recognized meat processor and packer. You get a contract to grow the lamb and sell them for meat regularly. You can get a constant paycheck on a monthly, quarterly, or yearly basis depending on your arrangement. You also get support services, including veterinary, marketing, and safety handling by experts. You only incur the risk of investing your capital, and you can still ensure the business against known risks to ensure you have a guarantee for your income.…